- Investabill™ ETR are a ‘cash equivalent’ competitor to bank deposit rates

- And should not be confused with Peer-2-Peer/P2P lending

| Overview | ||||

|

Most Peer-2-Peer/P2P loans are unsecured loans to individuals or businesses. Many Peer-2-Peer/P2P lending platforms specialise in specific types of loans, e.g. student loans, commercial and real estate loans, payday loans, unsecured business loans, leasing and/or factoring type loans. The interest rates on Peer-2-Peer/P2P loans are set by Investors/lenders that compete for the lowest rate. The lowest interest rate is achieved using a reverse auction model or is fixed by the auction platform based on an analysis of the borrower’s credit history. The interest an Investor receives should reflect the risk they are taking. This is because the Investor takes all the risk and their investment is rarely protected in any way.

|

||||

| Peer-2-Peer Risk | ||||

|

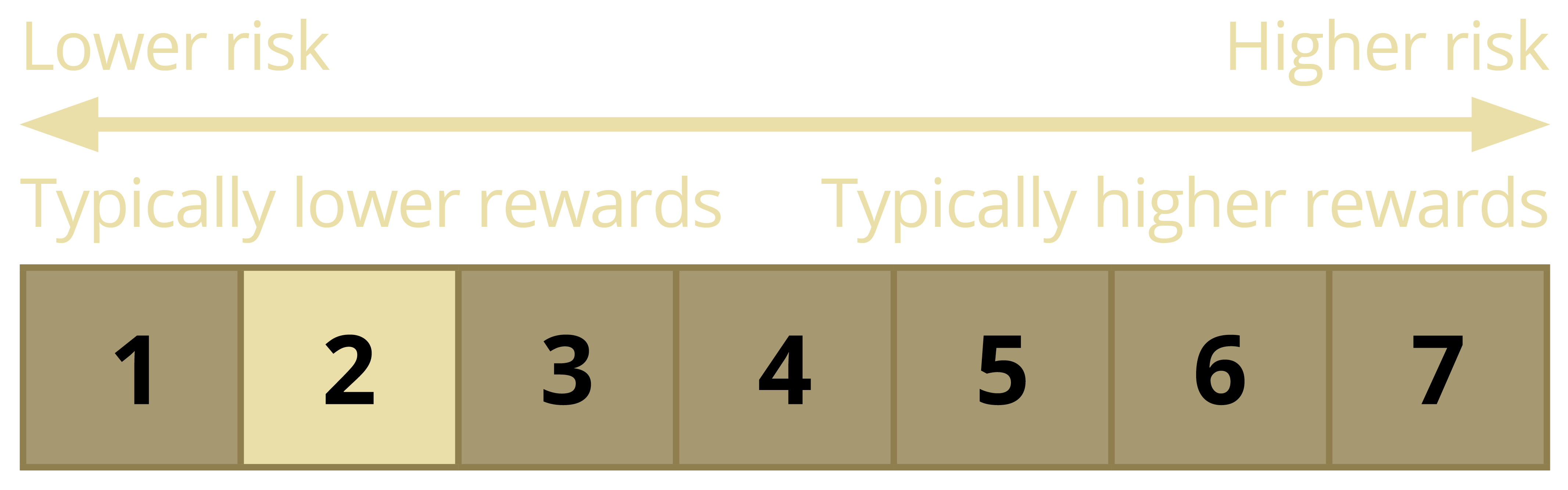

Peer-2-Peer/P2P lending is a high risk, high yield investment where: |

||||

The reasons outlined above is why borrowers perceive Peer-2-Peer/P2P loans as expensive (relative to traditional bank borrowing). And also explains why Investors regard Peer-2-Peer/P2P lending as high risk.

|

||||

| ETR Difference | ||||

|

Investabill™ ETR are not loans. They are Exchange Traded Receivables [ETR] that the Investor buys at a discount to the Face Value of the ETR. When the ETR is paid in full, the investment quality debtor pays the Face Value and this is how the Investors’ yield is generated. Investabill™ ETR offer a unique alternative to bank deposits with: | ||||

In addition to the above, Investabill™ ETR are only available to Investors that have received qualified financial advice from an Intermediary. |

|

|||

| ETR Risk | ||||

|

|

||||

|

||||