- Investabill™ ETR are specifically designed to protect every Investors’ funds

- By rigorous enforcement of the 4-Tier Capital Protection policy at all times

| |

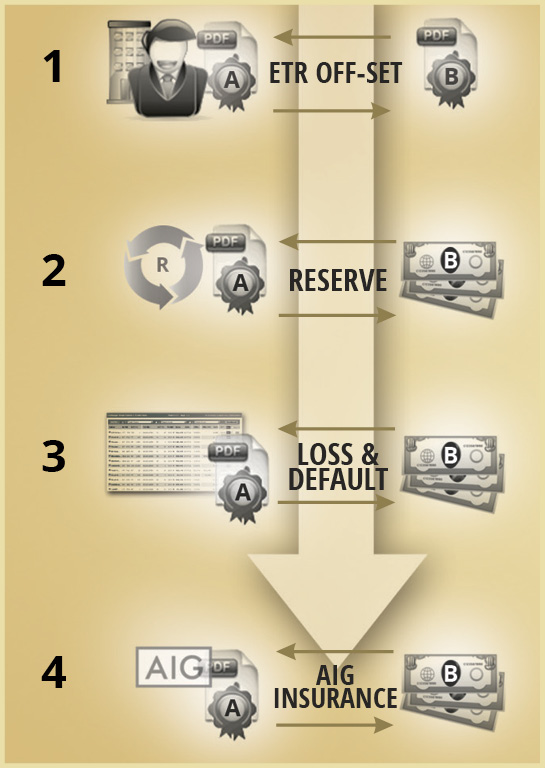

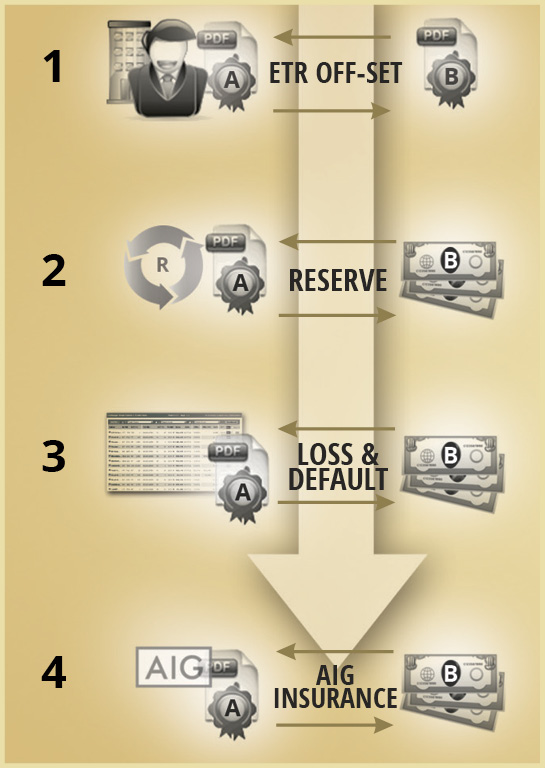

4-Tier Capital Protection

|

Investabill™ ETR have been specifically designed with the primary objective of protecting Investor funds and also to ensure that the agreed Buy rate/yield, or interest, is delivered. The simple, effective and tested set of capital and yield protection mechanisms are managed by the 4-Tier Capital Protection Policy. The 4-Tier Capital Protection Policy is extensively documented and rigorously enforced to deliver on the Credebt Exchange® commitment to Investors.

|

| |

|

|

|

1. ETR Off-Set

|

|

|

- Any unpaid ETR is replaced by a new Eligible ETR

- Credebt Exchange controls a large ‘pool’ of Investabill ETR

|

|

| |

|

|

2. Reserve

|

|

- 90% is the average amount paid to Purchase an ETR

- The remaining 10% Reserve protects against default

|

|

| |

|

|

3. Loss & Default

|

|

- All Traded ETR contribute to the Loss & Default fund

- Loss & Default fund supports ETR Repurchase exclusively

|

|

| |

|

|

4. AIG Insurance

|

|

- ETR specific AIG policy supports 4-Tier Capital Protection

- AIG Credit Default Protection [CDP] refunds Investors

|

|

| |

|

|

| |

|

|

IMPORTANT: 4-Tier Capital Protection is not a credit guarantee or commitment from Credebt Exchange®. Credebt Exchange® will only accept direct investment from qualified, professional Investors and all investors, regardless of circumstance, are advised to consult a qualified financial advisor or accountant. For more details, use the support form to contact us or call us on +353 1 685-3600.

|

|